The Office of State Treasurer supports public education by overseeing the management of school and institutional trust lands and funds, helping schools minimize the cost of financing facilities, and enhancing personal finance curriculum and standards.

School and Institutional Trust Funds

When Utah became a state in 1896, Congress granted approximately seven million acres of land into 12 separate trusts for the support of state institutions, the largest being a trust for the perpetual support of public schools.

When Utah became a state in 1896, Congress granted approximately seven million acres of land into 12 separate trusts for the support of state institutions, the largest being a trust for the perpetual support of public schools.

SITLA

The land has been administered by the School and Institutional Trust Lands Administration (SITLA) since its inception in 1994. SITLA has earned and contributed $1.87 billion in revenue for beneficiaries.

Learn More

SITFO

In 2014, the Utah Legislature created the School and Institutional Trust Fund Office (SITFO) as an independent state agency with a five-member Board of Trustees, chaired by the state treasurer, to invest the funds produced by SITLA’s administration of the land.

SITFO manages Utah’s $2.5 billion permanent funds investment portfolio. It invests the permanent endowments in a manner that supports annual distributions in perpetuity while providing for inter-generational equity between current and future beneficiaries.

Learn More

LTPAO

During the 2018 general session, the legislature authorized the Land Trusts Protection and Advocacy Office (LTPAO) to advocate for Utah trust lands beneficiaries, oversee SITLA and SITFO administrations, and help the public understand and support these endowments.

The LTPAO represents the beneficiary interests of the school and institutional trust with undivided loyalty. The Utah State Treasurer serves in a fiduciary capacity to trust beneficiaries providing oversight and support to the advocacy office. In accordance with the Utah Enabling Act, Utah Constitution, and state law, the advocacy office ensures productive use of and optimal revenue generation from trust lands, and prudent and profitable investment of trust funds.

The Office of State Treasurer provides oversight of the LTPAO jointly with the Land Trusts Protection and Advocacy Committee. Additionally, the office provides administrative and accounting support to SITFO and the LTPAO.

Learn more about the School and Institutional Trust System by watching this video:

School Bond Guaranty Program

The Utah School Bond Guaranty Program provides credit enhancement to voter-approved general obligation (GO) bonds issued by school districts. The program provides savings to taxpayers by pledging the full faith and credit of the state to the payment of voter-approved school district GO bonds. This provides qualifying school district bonds with the state’s top AAA credit rating, which corresponds with the lowest borrowing rates available.

Utah Charter School Finance Authority

The Utah State Charter School Finance Authority (UCSFA) was established in 2007 with the passage of the Charter School Financing Act.

Authority (UCSFA) was established in 2007 with the passage of the Charter School Financing Act.

Since its inception, the UCSFA has provided more than 55 Utah charter schools with access to the municipal bond market, totaling more than $820 million in financing.

Use of tax-exempt municipal bonds to finance schools helps to ensure that the cost of school facilities is kept to a minimum, enabling schools to focus resources on the classroom.

The Office of State Treasurer provides administrative and accounting support to the UCSFA, and Treasurer Oaks chairs its Board of Trustees.

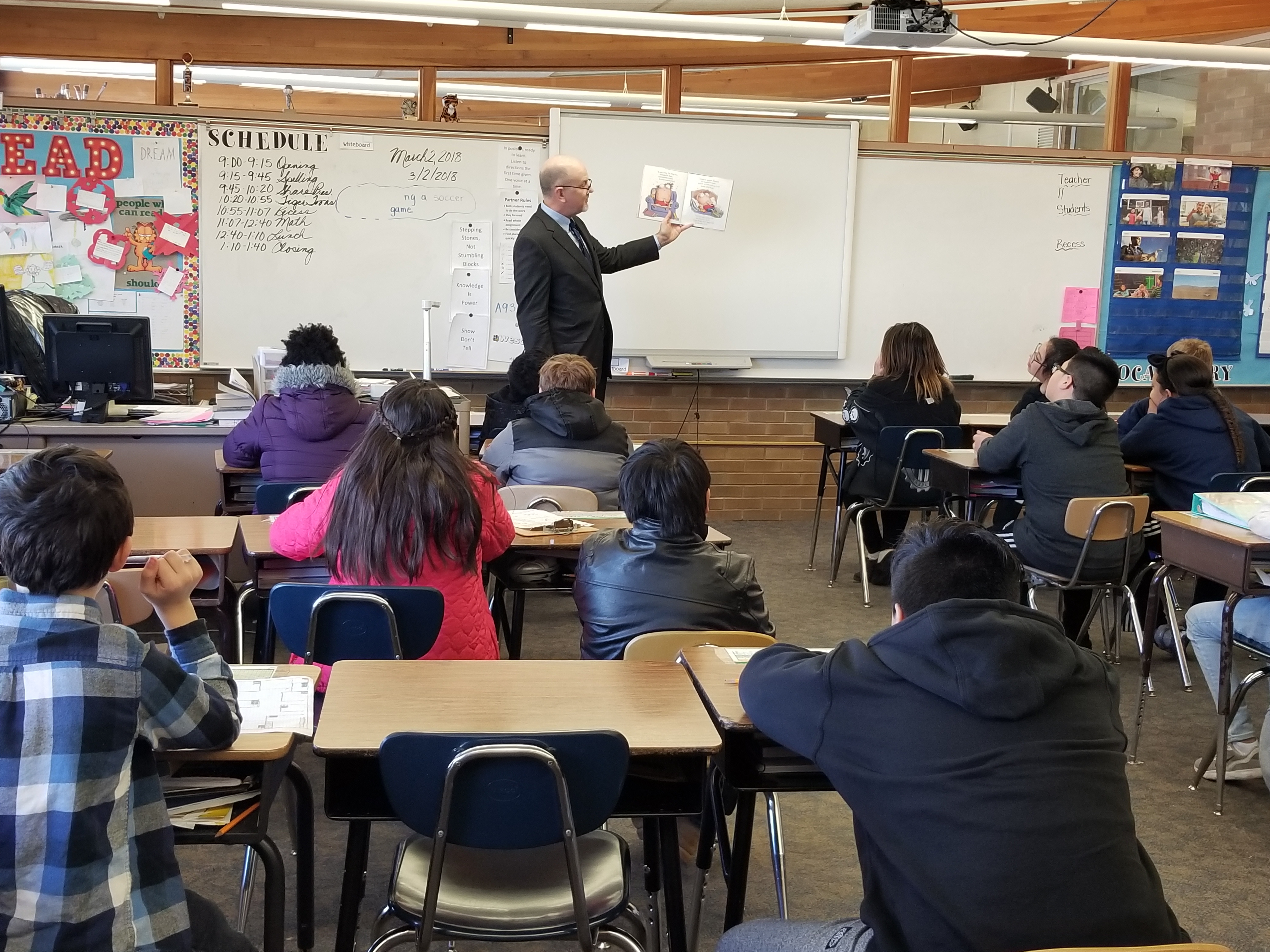

Financial Education in Utah Schools

Treasurer Oaks chairs the Utah Council on Financial and Economic Education (UCFEE), which was established by legislative resolution (SCR 3) in 2009. The council strives to improve financial and economic education in Utah through the collaboration of private and public entities that engage in teaching financial principles and share a commitment to empower individuals and families to achieve economic stability, opportunity, and upward mobility.

Treasurer Oaks chairs the Utah Council on Financial and Economic Education (UCFEE), which was established by legislative resolution (SCR 3) in 2009. The council strives to improve financial and economic education in Utah through the collaboration of private and public entities that engage in teaching financial principles and share a commitment to empower individuals and families to achieve economic stability, opportunity, and upward mobility.

One of UCFEE's primary objectives is to advocate for and strengthen financial education requirements and programming within the public education system. Local and national studies have found that students who take a financial literacy course have greater financial knowledge and improved behavior during their lifetime. Proper financial education teaches our youth critical financial concepts, and our robust and specific competency-based standards set us apart as the leader in the space.

Utah paves the way

Surprisingly, Utah consumers have a discreditable legacy of high bankruptcy rates and excessive debt. Personal finance experts became increasingly concerned for the future economic prosperity of Utahns in the early 2000s. They joined forces with teachers, community advocates, and the legislature to pass legislation in 2003 requiring students to complete a personal finance course in order to graduate, and in 2004, the State Board of Education approved a one-semester financial literacy class (General Financial Literacy). Utah was the first state to institute such a requirement.

This mandate equips more students with the knowledge and skills they need to make informed financial decisions and establishes a framework for Utah schools to provide quality financial education to students. Since the mandate was put in place , public officials, educators, and community advocates have worked together to strengthen and improve upon it.

Utah Office of State Treasurer Financial Literacy Initiatives

In addition to overseeing and orchestrating the work of UCFEE, the office administers the Stock Market Game and actively participates in the review and revision of the General Financial Literacy Strands and Standards and end-of-course exam.